It is crucial to monitor your credit score so you can head off financial problems before they become a significant concern. Additionally, it keeps you informed about your own credit, reducing the risk of unpleasant surprises when applying for loans or other services. ScoreSense Login helps users with low credit score issues and notifies them if anything suspicious takes place.

ScoreSense flags the account with suspicious activity and alerts the users to resolve the problem quickly. Members of ScoreSense receive credit scores and credit reports from all three credit bureaus, as well as daily credit monitoring and alerts, as well as tools to help them make sense of their scores.

It is important to remember that you have multiple credit scores and that they are always changing. Today, your credit score might not match the one a lender sees or the one you see next month since new information reported by lenders and other factors can alter your credit score.

How To Create A ScoreSense Account?

The only way for you to view your credit score studies and scores is to sign up for an account on ScoreSense. Because ScoreSense doesn’t disclose to customers its highly praised credit scores before they join, this is why they are highly praised. Create a ScoreSense Login account by following these steps:

- Visit the official website at www.scoresense.com to get started.

- In the right-hand corner of the homepage, you will find a link to sign in.

- To create an account, click the Create Account button underneath the login form when the login page opens.

- You have to enter details like your full name, email address, zip code, etc., on the registration page.

- Lastly, click on the Get Your Scores-NOW button to complete the registration process.

- You will need a username and password to log into the login portal to access your credit score.

ScoreSense Login gives you access to your credit studies and your credit scores once you become a member. Additionally, as a subscriber, you will also have access to your fico score and credit report from any consumer reporting agency.

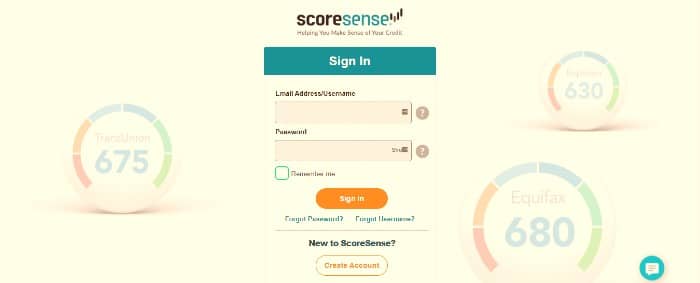

What Is The Procedure For ScoreSense Login?

ScoreSense is a membership service that allows you to monitor your credit history, correct inaccuracies on your credit report, and protect against identity theft in an easy and convenient manner. Furthermore, ScoreSense Sign In site could alert you to possible predators in your neighborhood.

The ScoreSense Login procedure will explain the many unique features and benefits of this service. You can monitor your credit history, correct inaccuracies on your credit report, and monitor threats to your identity with the membership service quickly and conveniently. Here are the steps you can take to access the ScoreSense Login Page.

- To begin with, you should visit www.scoresense.com.

- Click on the sign-in button on the top right corner of the page.

- After clicking the sign-in button, you will be redirected to the login page.

- In this section, you must enter your email address as your username.

- Enter the password that you created during registration.

- After verifying the information, click on the Sign In button.

You can access all the features by logging into the ScoreSense Dashboard after logging in. You can use the “?” icons and “Learn More” links to help you understand the features you don’t understand, which will help you get the most of your ScoreSense Membership.

Checking Credit Score On ScoreSense App

ScoreSense offers a 7-day free trial that will help you comprehend its usage practically. Continuing to use their services will give you full access to the website and its benefits, thereby allowing you to learn more about maintaining a good credit score and getting competitive offers on loans. Here’s how you can check your credit score using ScoreSense App.

- Enter your personal information.

- Select a suitable reason for checking your credit score.

- Create a password with ScoreSense.

- Enter the details of your credit card for a refundable fee of $1.

- Check your credit score.

It’s that simple! Establishing a good credit score can make your financial life much easier by helping you quickly get loans at competitive interest rates. The insightful tools and features offered by ScoreSense App enable you to manage and improve your credit score. Regular monitoring of your credit can help you make smart money decisions that can positively affect your credit rating.

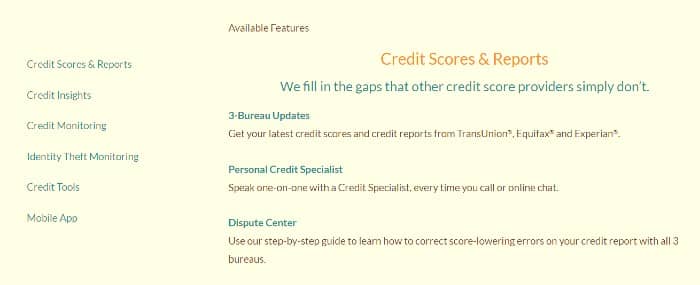

Available Features On Score Sense

Identity Theft Protection

The identity report allows you to view potential threats to your identity that ScoreSense has detected. In order to detect fraudulent use of your personal information, they scan the internet, payday loan records, criminal and public records, and more.

Whenever you change your address, get a payday loan, or have a criminal record added to your name, Score Sense will notify you. With their neighborhood report, you can find out how many sex offenders live near you as well as a comprehensive map that includes panoramic street views, details, and photos of offenders in your area.

There is an opportunity for members to receive up to $1,000,000 towards the cost of recovering from identity theft. Insurance company subsidiaries or affiliates of American International Group, Inc. underwrite their identity theft insurance.

Monitoring and Alerts

You can track your credit score progress month by month with ScoreTracker to help you achieve your credit goals. Credit scores from all three bureaus can be plotted for up to two years with these programs. ScoreCase is another feature that shows how your credit score may change after taking certain actions against your credit.

Your credit history is updated when important changes happen, such as delinquent payments or new accounts. Depending on the alert, you might need to take action. The details of each alert are accompanied by links that lead to helpful information and tips for further action.

Credit Insights

The credit bureaus used by lenders for credit checks may not be the same – and your scores may vary. It shows you which factors most affect your TransUnion credit score, Equifax credit score, and Experian credit score, so you know where you stand whichever bureau your lender uses.

The accuracy of your credit reports is only as good as the information provided by your creditors. You can use their Credit Report Analysis to compare your TransUnion credit report, Equifax credit report, and Experian credit report to identify accounts that may affect your credit score.

| Official Name | ScoreSense |

|---|---|

| Country | USA |

| Mobile App | Available |

| Managed By | One Technologies LLC |

| Primary Use | Check Credit Score |

What Are the Benefits of ScoreSense Membership?

There are many ways to improve your credit scores. You can get your credit scores for free using some online services, and you are legally entitled to one free credit report from each bureau each year. ScoreSense Login, however, has some advantages over free credit reports that free credit reports do not have.

- You can access your credit reports and scores from all three major credit bureaus – Equifax, Experian, and TransUnion. But most credit score providers only provide a single score.

- Your credit reports are updated monthly. Additionally, they regularly update your report. The information you receive from your free annual credit report is only available once. It is possible that you will not know about any changes in your credit report in the next year.

- Knowing someone is watching your credit report on a daily basis can bring you peace of mind. The automated system of ScoreSense tracks changes to your credit report and helps identify potential fraud or issues that could impact your credit scores or access to credit or services.

- When you receive credit alerts, you are notified of important changes or suspicious activity on your report so you can take action if necessary.

- They can help with any questions or concerns you have about your reports or scores by calling them or chatting online. It can help demystify some of the more complex items on your report and help you better understand what impacts your credit score.

About ScoreSense

ScoreSense is a membership service that allows you to manage your credit history, resolve errors in your credit report, and guard against identity theft in a convenient and straightforward way. Additionally, ScoreSense Sign In could let you know about possible predators in your neighborhood.

One Technologies, LLC has partnered with data management innovator Arrikto Inc. to incorporate Machine Learning (ML) into its ScoreSense credit platform to offer customers the best possible credit experience. One Technologies, LLC is based in Dallas, Texas, and was founded in 2000.

Using the latest machine learning products the industry has to offer, it delivers the most up-to-date credit information available. The partnership has been successful because One Technologies aligns seamlessly with the most innovative developers in the ML space and understands the value of data to serve customers more effectively.

ScoreSense.com claims to make it easy for people to manage their credit, stay protected from identity thieves, and learn whether or not criminals inhabit their area. ScoreSense serves as a one-stop digital resource for consumers to access credit scores and reports from all three main credit bureaus, TransUnion, Equifax, and Experian, and to pinpoint which factors are most affecting their credit scores.

Frequently Asked Questions

My ScoreSense Welcome email never arrived. What can I do?

ScoreSense will send you a welcome email with important membership information within 24 hours of joining. If you did not receive this important email, check your Spam folder and make sure to add [email protected] to your address book. Also, visit your account page to ensure they have your correct address on file.

How should I respond to a credit alert?

Depending on the type of alert you receive, you should take action. Below the details of each alert, you’ll find links that will direct you to helpful information and tips for further action.

How can I contact ScoreSense Customer Service?

You can contact the ScoreSense Customer Service department at 1-800-972-7204. We are available to assist you every day of the week:

- Monday through Friday 8 AM to 8 PM CST,

- Saturday 8 AM to 5 PM CST,

- and Sunday Noon to 6 PM CST.

What exactly is ScoreTracker?

ScoreTracker allows you to chart your monthly credit scores from Equifax, Experian, and TransUnion over a 12-month period so you can quickly view your score history. You can also compare yourself to others nationally, by age group, and by state.

What if I discover a mistake or fraud on my credit report?

Errors in credit reports can cost you money and effort. As soon as you uncover erroneous information, you should file a dispute with the credit reporting agencies. The Dispute Center provides a step-by-step guide for filing grievances with Equifax, Experian, and TransUnion. If you are a member and spot signs of identity theft on your credit reports, you can refer to the ScoreSense Identity Theft Recovery Guide.

Closing Remarks

The credit management services offered by www.scoresense.com fall into three categories: credit reports & scores, credit monitoring, and identity & personal protection. You can use ScoreCast to manage your credit by observing what would happen if you missed a payment or if you paid off certain debts.

If you are interested in signing up, you might want to contact customer service to see if they are running any promotions to lower your monthly payment. Currently, they charge $29.95 per month after the seven-day trial period.