ScoreSense said in a statement that its technology, Credit Insights, can identify any differences in account reporting that can lower an individual’s credit score. In turn, those reports are presented in an easy-to-understand manner that makes it easy for customers to identify problems and fix them.

With the help of ScoreSense customers can also obtain answers to questions related to their scores, reports, or the process of disputing and correcting errors or differences in account reporting by contacting ScoreSense’s customer service department.

Credit Monitoring and Insights

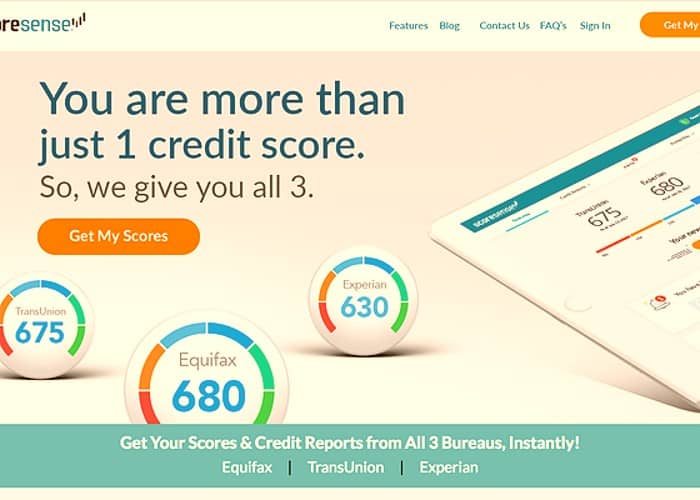

- With easy access to your most recent credit scores and credit reports all in one place, you can see what lenders may see when you need it – and from all three credit bureaus: TransUnion, Equifax, and Experian.

- According to the information reported by your creditors, your credit scores and reports change; the good, the bad, and even the inaccurate. Your credit report and score from each of the three bureaus can be updated monthly to help you check for errors and avoid surprises!

- Your credit questions will be answered regardless of how long it takes. With our Credit Specialists, we can help you understand how your credit scores are determined, identify the key factors that affect them, and help you improve them.

- You could be the victim of identity theft if you have inaccurate or outdated information on your credit reports. In our Dispute Center, we provide a step-by-step guide on how to file a dispute with all three credit bureaus.

- The credit bureaus used by lenders for credit checks may not be the same – and your scores may vary. With ScoreSense, you know which factors are most affecting your TransUnion, Equifax, and Experian credit scores, so no matter which bureau lenders use, you know where you stand.

- The accuracy of your credit reports is only as good as the information provided by your creditors. By comparing your TransUnion credit report, Equifax credit report, and Experian credit report, we can identify account discrepancies that can affect your credit score.